If the government raises taxes do revenues increase to pay off the deficit or increase government programs? Disregarding other factors such as government large or small (what’s that like) government spendig, or the economy being robust or limp (and they are tied together), the answer is very simple as has been demonstrated by past tax cuts and increases.

The Laffer Curve

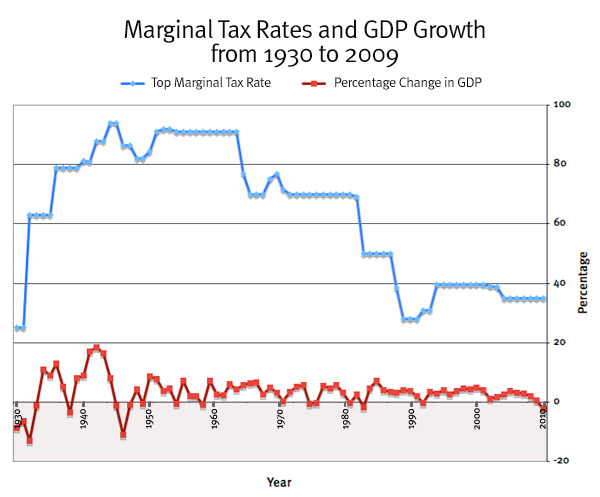

Tax hikes on the left side increases government revenues, and contrariwise, ones on the right lower revenues. Most notably, tax cuts under JFK, Reagan and Bush II did increase revenues–under Reagan, dramatically, even though gov. spending was increased. The tax hikes in the 70’s lowered revenues and trashed the economy under Carter.

It is arguable where t* occurs at which our economy is optimized (probably around 25%), but it’s usually easy to tell if you’re too far off to one side or the other–and right now, with our current economy, we’re way off to the right (which is Left of course.)

And since this is Econ-102, the second point is that economics is not a zero sum game. If the rich get richer, the poor get richer as well–IN AN ECONOMICALLY FREE COUNTRY. Or, as JFK said, a rising tide lifts all boats.