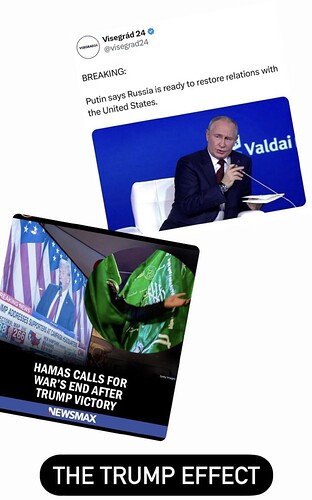

Words, yes.

But actions?

Aplenty. How will the neutrality wished for globally paint not so a pretty picture of what?

A global widening of tension, or a whisked for narrowing of a saturated powder keg.?.

)(

)( > ) x ( > ?

It is difficult to wish for or hope for a peace to fill the chasm that would differentiate between the quasi wilsonian neutrality that could fill a substantial price Russia demands for cessation of hostilities, with the dissemination and proliferation of many global conflicts sprouting up to fill a widening space that has been left empty of the process to achieve it(a piece of such peace)

The connective signs are below general apprehension, and as such are viewed suspiciously as deceptively too simple, but a resurgence of conspiracy is like a snake swallowing it’s own tail (tale)

The procedure , the proposals are hidden by the promotions that feed such enigmatic internal dialogues, proformally, apparently scared of it’s own shadow, barring a preformed performance to smoothly function accordingly.

What goes on here? All are conflated , but the snake does deceive, and those who mistakenly overreacted way back , having lost the kernel of that apple, that mankind swallowed, has given us another chance to repair that damage. The axiomatically natural response has already bypassed natural sentiment understanding, now, it’s time to catch up and see that the sheeple can hardly keep up or go ahead.

That is why the most powerful man in the White House, is and must be a psychopathic criminal himself, vis. only evil can match the fight another, more terrible evil can pro pose.

Ps. Pope Francis himself struggling with Gnosis heresy, said of the US election as advice to the voting public: ‘Choose between the lesser of two evils’

What he could not mention about the in- gestation between which one is really preferably a necessary choice, and that bell jar indicates the exact opposite of what is meant here in this context.

And yes, it is to save space, for spatial temporal forces forced the reversal of the shrinking diaspora, of having those unfortunate people obliged to be chosen , to save man’s overall identifiable traits as those which are constituted to be apart and a part from that which are less then human

That is why, the superior supernatural signs need to be heeded to.

God, were floored, we are, but with and in unity is unfathomable strength.

()